W

WThe Avignon Exchange was one of the first foreign exchange markets in history, established in the Comtat Venaissin during the Avignon Papacy. The Exchange was composed of the agents (factores) of the great Italian banking-houses, who acted as money-changers as well as financial intermediaries between the Apostolic Camera and its debtors and creditors. The most prosperous quarter of the city of Avignon, where the bankers settled, became known simply as the Exchange. According to de Roover, "Avignon can be considered an Italian colony, since the papal bankers were all Italians".

W

WThe bond market is a financial market where participants can issue new debt, known as the primary market, or buy and sell debt securities, known as the secondary market. This is usually in the form of bonds, but it may include notes, bills, and so for public and private expenditures. The bond market has largely been dominated by the United States, which accounts for about 39% of the market. As of 2021, the size of the bond market is estimated to be at $119 trillion worldwide and $46 trillion for the US market, according to Securities Industry and Financial Markets Association (SIFMA).

W

WThe Bretton Woods Conference, formally known as the United Nations Monetary and Financial Conference, was the gathering of 730 delegates from all 44 Allied nations at the Mount Washington Hotel, situated in Bretton Woods, New Hampshire, United States, to regulate the international monetary and financial order after the conclusion of World War II.

W

WA financial centre, financial center, or financial hub is a location with a concentration of participants in banking, asset management, insurance or financial markets with venues and supporting services for these activities to take place. Participants can include financial intermediaries, institutional investors, and issuers. Trading activity can take place on venues such as exchanges and involve clearing houses, although many transactions take place over-the-counter (OTC), that is directly between participants. Financial centres usually host companies that offer a wide range of financial services, for example relating to mergers and acquisitions, public offerings, or corporate actions; or which participate in other areas of finance, such as private equity and reinsurance. Ancillary financial services include rating agencies, as well as provision of related professional services, particularly legal advice and accounting services.

W

WThe Chiang Mai Initiative (CMI) is a multilateral currency swap arrangement among the ten members of the Association of Southeast Asian Nations (ASEAN), the People's Republic of China, Japan, and South Korea. It draws from a foreign exchange reserves pool worth US$120 billion and was launched on 24 March 2010. That pool has been expanded to $240 billion in 2012.

W

WCounterparty is a peer-to-peer financial platform and distributed, open source Internet protocol built on top of the Bitcoin blockchain and network. It was one of the most well-known "Bitcoin 2.0" platforms in 2014, along with Mastercoin, Ethereum, Colored Coins, Ripple and BitShares. It is a "metacoin"-type protocol. It provides such features as tradable user-created currencies, additional financial instruments and a decentralized asset exchange. In November of 2014, Counterparty added support for the Ethereum Virtual Machine to the Counterparty protocol and allowing all Ethereum decentralized applications to be run on the Bitcoin blockchain within the Counterparty protocol.

W

WCurrency depreciation is the loss of value of a country's currency with respect to one or more foreign reference currencies, typically in a floating exchange rate system in which no official currency value is maintained. Currency appreciation in the same context is an increase in the value of the currency. Short-term changes in the value of a currency are reflected in changes in the exchange rate.

W

WA currency basket is a portfolio of selected currencies with different weightings. A currency basket is commonly used by investors to minimize the risk of currency fluctuations and also governments when setting the market value of a country’s currency.

W

WA currency board is a monetary authority which is required to maintain a fixed exchange rate with a foreign currency. This policy objective requires the conventional objectives of a central bank to be subordinated to the exchange rate target.

W

WCurrency intervention, also known as foreign exchange market intervention or currency manipulation, is a monetary policy operation. It occurs when a government or central bank buys or sells foreign currency in exchange for its own domestic currency, generally with the intention of influencing the exchange rate and trade policy.

W

WCurrency substitution, dollarization is the use of a foreign currency in parallel to or instead of the domestic currency.

W

WDynamic currency conversion (DCC) or cardholder preferred currency (CPC) is a process whereby the amount of a credit card transaction is converted at the point of sale, ATM or internet to the currency of the card's country of issue. DCC is generally provided by third party operators in association with the merchant, and not by a card issuer, such as Visa or Mastercard. Card issuers permit DCC operators to offer DCC in accordance with the card issuers’ processing rules. However, using DCC, the customer is usually charged an amount in excess of the transaction amount converted at the normal exchange rate, though this may not be obviously disclosed to the customer at the time. The merchant, the merchant's bank or ATM operator usually impose a markup on the transaction, in addition to the exchange rate that would normally apply, sometimes by as much as 18%.

W

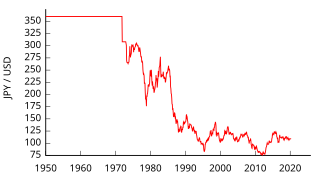

WEndaka or Endaka Fukyo is a state in which the value of the Japanese yen is high compared to other currencies. Since the economy of Japan is highly dependent on exports, this can cause Japan to fall into an economic recession.

W

WA euro calculator is a very popular type of calculator in European countries that adopted the euro as their official monetary unit. It functions like any other normal calculator, but it also includes a special function which allows one to convert a value expressed in the previously official unit to the new value in euros, or vice versa. Its use became very popular within the population and commerce of these countries especially during the first few months after adopting the euro.

W

WIn finance, an exchange rate is the rate at which one currency will be exchanged for another currency. Currencies are most commonly national currencies, but may be sub-national as in the case of Hong Kong or supra-national as in the case of the euro.

W

WThe industry which has a range of businesses that deal with money like banks, insurance companies, accounting companies, finance companies, taxation, investment funds, credit companies, and few government enterprises is called the finance industry. The activities or services within this industry that cater to the economy of the country are called financial services. Therefore, the economic services provided by the finance industry in Japan are called financial services in Japan. These services are present across the world, at regional, international and national level developed economic and demographic regions such as Sydney, New York, London, Tokyo, etc.

W

WIn macroeconomics and economic policy, a floating exchange rate is a type of exchange rate regime in which a currency's value is allowed to fluctuate in response to foreign exchange market events. A currency that uses a floating exchange rate is known as a floating currency, in contrast to a fixed currency, the value of which is instead specified in terms of material goods, another currency, or a set of currencies.

W

WForeign exchange controls are various forms of controls imposed by a government on the purchase/sale of foreign currencies by residents, on the purchase/sale of local currency by nonresidents, or the transfers of any currency across national borders. These controls allow countries to better manage their economies by controlling the inflow and outflow of currency, which may otherwise create exchange rate volatility. Countries with weak and/or developing economies generally use foreign exchange controls to limit speculation against their currencies. They may also introduce capital controls, which limit foreign investment in the country.

W

WForex Club is a group of companies participating in the retail market of Forex. The Libertex brand operates and its structure includes financial and educational companies.

W

WFundamental analysis, in accounting and finance, is the analysis of a business's financial statements ; health; and competitors and markets. It also considers the overall state of the economy and factors including interest rates, production, earnings, employment, GDP, housing, manufacturing and management. There are two basic approaches that can be used: bottom up analysis and top down analysis. These terms are used to distinguish such analysis from other types of investment analysis, such as quantitative and technical.

W

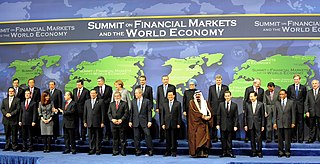

WThe 2008 G20 Washington Summit on Financial Markets and the World Economy took place on November 14–15, 2008, in Washington, D.C., United States. It achieved general agreement amongst the G20 on how to cooperate in key areas so as to strengthen economic growth, deal with the 2008 financial crisis, and lay the foundation for reform to avoid similar crises in the future. The Summit resulted from an initiative by the French and European Union President, Nicolas Sarkozy, Australian Prime Minister Kevin Rudd, and the British Prime Minister, Gordon Brown. In connection with the G7 finance ministers on October 11, 2008, United States President George W. Bush stated that the next meeting of the G20 would be important in finding solutions to the economic crisis. Since many economists and politicians called for a new Bretton Woods system to overhaul the world's financial structure, the meeting has sometimes been described by the media as Bretton Woods II.

W

WThe impossible trinity is a concept in international economics which states that it is impossible to have all three of the following at the same time:a fixed foreign exchange rate free capital movement an independent monetary policy

W

WMatchbook FX was an internet-based electronic communication network for trading currency online in the Spot-FX or foreign exchange market. It operated between 1999 and 2002.

W

WMonetary hegemony is an economic and political concept in which a single state has decisive influence over the functions of the international monetary system. A monetary hegemon would need:accessibility to international credits, foreign exchange markets the management of balance of payments problems in which the hegemon operates under no balance of payments constraint. the direct power to enforce a unit of account in which economic calculations are made in the world economy.

W

WThe Plaza Accord was a joint–agreement signed on September 22, 1985, at the Plaza Hotel in New York City, between France, West Germany, Japan, the United Kingdom, and the United States, to depreciate the U.S. dollar in relation to the French franc, the German Deutsche Mark, the Japanese yen and the British Pound sterling by intervening in currency markets. The U.S. dollar depreciated significantly from the time of the agreement until it was replaced by the Louvre Accord in 1987. Some commentators believe the Plaza Accord contributed to the Japanese asset price bubble of the late 1980s.

W

WRenminbi currency value is a debate affecting the Chinese currency unit, the renminbi. The renminbi is classified as a fixed exchange rate currency "with reference to a basket of currencies", which has drawn attention from nations which have freely floated currency and has become a source of trade friction with Western nations.

W

WThe spot market or cash market is a public financial market in which financial instruments or commodities are traded for immediate delivery. It contrasts with a futures market, in which delivery is due at a later date. In a spot market, settlement normally happens in T+2 working days, i.e., delivery of cash and commodity must be done after two working days of the trade date. A spot market can be through an exchange or over-the-counter (OTC). Spot markets can operate wherever the infrastructure exists to conduct the transaction.

W

WIn economics, a Swan Diagram, also known as the Australian model, represents the situation of a country with a currency peg.

W

WThe trade-weighted effective exchange rate index, a common form of the effective exchange rate index, is a multilateral exchange rate index. It is compiled as a weighted average of exchange rates of home versus foreign currencies, with the weight for each foreign country equal to its share in trade. Depending on the purpose for which it is used, it can be export-weighted, import-weighted, or total-external trade weighted.

W

WThe trade-weighted US dollar index, also known as the broad index, is a measure of the value of the United States dollar relative to other world currencies. It is a trade weighted index that improves on the older U.S. Dollar Index by using more currencies and the updating the weights yearly. The base index value is 100 in Jan 1997.

W

WThe U.S. Dollar Index is an index of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners' currencies. The Index goes up when the U.S. dollar gains "strength" (value) when compared to other currencies.

W

WThe United Stock Exchange of India (USE) is an Indian government owned stock exchange. It is the 4th pan India exchange launched for trading financial instruments in India. USE represents the commitment of 21 Indian public sector banks, private banks, international banks and corporate houses to build an institution of repute.

W

WThe World Currency Unit WOCU (XCU) is an EU trademarked synthetic global currency quotation. It is derived from a weighted basket of currencies of fiat currency pairs covering the top 20 economies of the world. Each country’s currency representation is weighted by its relative proportion of the top 20 economies as measured by GDP. The WOCU’s nearest comparator was the more narrowly constructed ECU, the European Currency Unit basket that preceded the successor Euro.

W

WIn international finance, a world currency, supranational currency, or global currency is a currency that would be transacted internationally, with no set borders.