W

WIn economics, a commodity is an economic good, usually a resource, that has full or substantial fungibility: that is, the market treats instances of the good as equivalent or nearly so with no regard to who produced them.

W

WIn the field of economics, the commodity value of a good is its free market intrinsic value under optimal use conditions. In a free market, the commodity value of a good will be reflected by its price. For example, if an acre of land can yield a net of 100 dollars loss by lying fallow, 50 dollars gain by being planted with corn, and 100 dollars gain by being planted with wheat, then that acre's commodity value is 100 dollars; the farmer is assumed to put his land to best use. The price of a commodity fluctuates around its commodity value.

W

WThe value of diamonds as an investment is of significant interest to the general public, because they are expensive gemstones, often purchased in engagement rings, due in part to a successful 20th-century marketing campaign by De Beers. The difficulty of properly assessing the value of an individual gem-quality diamond complicates the situation. The end of the De Beers monopoly and new diamond discoveries in the second half of the 20th century have reduced the resale value of diamonds. Recessions have engendered greater interest in investments that exhibit safe-haven or hedging properties that are uncorrelated to investments in the equities markets. Academic studies have indicated that investments in physical diamonds exhibit greater safe-haven characteristics than investments in diamond indices.

W

WOf all the precious metals, gold is the most popular as an investment. Investors generally buy gold as a way of diversifying risk, especially through the use of futures contracts and derivatives. The gold market is subject to speculation and volatility as are other markets. Compared to other precious metals used for investment, gold has been the most effective safe haven across a number of countries.

W

WIn 2020, Lithium has been included in the list for Critical global elements critical metal, and will be one of the drivers of the fourth industrial revolution. Lithium company stocks on the worldwide exchanges have rallied from the end of 2020 and through 2021 with many Lithium Explorers/Developers/Producer miners' share prices' rising 1000% to 6000% within 12 months on the ASX: the Australian Securities Stock Exchange. Stocks are expected to continue to rally as a shortfall deficit of Lithium supply world-wide is expected from beginning of 2022. The Battery-grade Lithium deficit is expected to persist to an incredible 2030, as there are not enough mines coming online to supply the demand in EV Batteries & Energy Storage systems to 2030. This makes Lithium a highly lucrative commodity to invest into, the term entered a "Lithium commodities Super-cycle" has been used by industry commentators during 2021 to describe the event, also the term "A Once in a Century" event is occurring in 2021 and will persist till new Energy technologies come online to replace Lithium Batteries, this is not expected till after 2040 as there are no technologies that will be suitable for the diversity of applications for Lithium Energy storage systems. Lithium carbonate prices have made a resurgence from 2019-2020 all time lows, rising some 500% as of 21/11/2021 trading at US$29,000/tonne, Lithium Carbonate/Lithium Hydroxide is a Lithium chemical compound also known as LCE(Lithium Carbonate Equivalent) and is used as a Precursor in the manufacture of Cathode Cells for electric vehicle (EV) batteries. As a result and along with major Governmental new energy policies in 2020, in preparation to the fazing out of fossil fuels & reductions in carbon emissions vehicles & coal power, has kick-started a flurry of renewed investments & Joint Ventures/acquisitions between Miners & Strategic major investor companies throughout the world. Recently the world saw the COP26: Climate Change Summit for Action in Glasgow during November 2021. The agreements signed by all countries involved, has accelerated the action towards renewables adoption & the reforestation among other items & actions. Lithium will play a key & critical role towards the reduction of Carbon emissions, "1.5ToStayAlive" "1.5toSurvive" slogans for maintaining the critical 1.5 degrees & the storage of renewables clean green energy, harnessed from the sustainable wind, solar & hydropower, also tidal. Also big on the COP26 agenda was the fazing out of coal all-together.

W

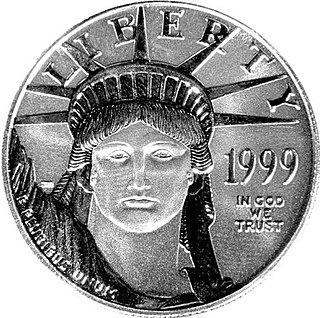

WPlatinum as an investment has a much shorter history in the financial sector than gold or silver, which were known to ancient civilizations. Experts posit that platinum is about 15–20 times scarcer than gold, on the basis of annual mine production. Since 2014, platinum rates have fallen significantly lower than gold rates. More than 75% of global platinum is mined in South Africa.

W

WSilver may be used as an investment like other precious metals. It has been regarded as a form of money and store of value for more than 4,000 years, although it lost its role as legal tender in developed countries when the use of the silver standard came to a final end in 1935. Some countries mint bullion and collector coins, however, such as the American Silver Eagle with nominal face values. In 2009, the main demand for silver was for industrial applications (40%), jewellery, bullion coins, and exchange-traded products. In 2011, the global silver reserves amounted to 530,000 tonnes.