W

WThe America Creating Opportunities to Meaningfully Promote Excellence in Technology, Education, and Science Act of 2007 or America COMPETES Act was authored by Bart Gordon and signed by President George W. Bush; it became law on 9 August 2007. This was an Act, "To invest in innovation through research and development, and to improve the competitiveness of the United States."

W

WThe American Jobs Creation Act of 2004 was a federal tax act that repealed the export tax incentive (ETI), which had been declared illegal by the World Trade Organization several times and sparked retaliatory tariffs by the European Union. It also contained numerous tax credits for agricultural and business institutions as well as the repeal of excise taxes on both fuel and alcohol and the creation of tax credits for biofuels.

W

WThe American Recovery and Reinvestment Act of 2009 (ARRA), nicknamed the Recovery Act, was a stimulus package enacted by the 111th U.S. Congress and signed into law by President Barack Obama in February 2009. Developed in response to the Great Recession, the primary objective of this federal statute was to save existing jobs and create new ones as soon as possible. Other objectives were to provide temporary relief programs for those most affected by the recession and invest in infrastructure, education, health, and renewable energy.

W

WThe American Taxpayer Relief Act of 2012 was enacted and was passed by the United States Congress on January 2, 2013, and was signed into law by US President Barack Obama the next day.

W

WPresident Ulysses S. Grant signed a series of laws during his first and second terms that limited the number of special tax agents and prevented or reduced the collection of delinquent taxes under a commissions or moiety system. The public outcry over the Sanborn incident caused the Grant administration to abolish the practice of appointing special treasury agents to collect commissions or moieties on delinquent taxes.

W

WThe Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) is a law passed by the U.S. Congress on a reconciliation basis and signed by President Ronald Reagan that, among other things, mandates an insurance program which gives some employees the ability to continue health insurance coverage after leaving employment. COBRA includes amendments to the Employee Retirement Income Security Act of 1974 (ERISA). The law deals with a great variety of subjects, such as tobacco price supports, railroads, private pension plans, emergency department treatment, disability insurance, and the postal service, but it is perhaps best known for Title X, which amends the Internal Revenue Code and the Public Health Service Act to deny income tax deductions to employers for contributions to a group health plan unless such plan meets certain continuing coverage requirements. The violation for failing to meet those criteria was subsequently changed to an excise tax.

W

WThe Cooperative and Small Employer Charity Pension Flexibility Act is a law that allows some charities, schools, and volunteer organizations to remain exempt from pension plan rules under the Employee Retirement Income Security Act of 1974 (ERISA) and the Internal Revenue Code.

W

WThe Dingley Act of 1897, introduced by U.S. Representative Nelson Dingley Jr., of Maine, raised tariffs in United States to counteract the Wilson–Gorman Tariff Act of 1894, which had lowered rates. The bill came into effect under William McKinley the first year that he was in office. The McKinley administration wanted to bring back the protectionism slowly that was proposed by the Tariff of 1890.

W

WThe Economic Growth and Tax Relief Reconciliation Act of 2001 was a major piece of tax legislation passed by the 107th United States Congress and signed by President George W. Bush. It is also known by its abbreviation EGTRRA, and is often referred to as one of the two "Bush tax cuts".

W

WThe Economic Recovery Tax Act of 1981 (ERTA), or Kemp-Roth Tax Cut, was an Act that introduced a major tax cut, which was designed to encourage economic growth. The federal law enacted by the 97th US Congress and signed into law by US President Ronald Reagan. The Accelerated Cost Recovery System (ACRS) was a major component of the Act and was amended in 1986 to become the Modified Accelerated Cost Recovery System (MACRS).

W

WThe Emergency Tariff of 1921 of the United States was enacted on May 27, 1921. The Underwood Tariff, passed under President Woodrow Wilson, had Republican leaders in the United States Congress rush to create a temporary measure to ease the plight of farmers until a better solution could be put into place. With growing unrest in the American public, President Warren G. Harding and Congress passed the tariff.

W

WThe Energy Policy Act of 2005 is a federal law signed by President George W. Bush on August 8, 2005, at Sandia National Laboratories in Albuquerque, New Mexico. The act, described by proponents as an attempt to combat growing energy problems, changed US energy policy by providing tax incentives and loan guarantees for energy production of various types. The law also exempted hydraulic fracturing fluids from regulation under several environmental laws, and it repealed the Public Utility Holding Company Act of 1935, effective February 2006.

W

WThe Federal Insurance Contributions Act is a United States federal payroll contribution directed towards both employees and employers to fund Social Security and Medicare—federal programs that provide benefits for retirees, people with disabilities, and children of deceased workers.

W

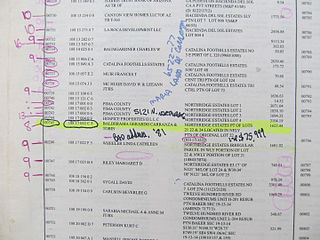

WA tax lien is a lien imposed by law upon a property to secure the payment of taxes. A tax lien may be imposed for delinquent taxes owed on real property or personal property, or as a result of failure to pay income taxes or other taxes.

W

WThe Foreign Account Tax Compliance Act (FATCA) is a 2010 United States federal law requiring all non-U.S. foreign financial institutions (FFIs) to search their records for customers with indicia of a connection to the U.S., including indications in records of birth or prior residency in the U.S., or the like, and to report the assets and identities of such persons to the U.S. Department of the Treasury. FATCA also requires such persons to report their non-U.S. financial assets annually to the Internal Revenue Service (IRS) on form 8938, which is in addition to the older and further redundant requirement to report them annually to the Financial Crimes Enforcement Network (FinCEN) on form 114. Like U.S. income tax law, FATCA applies to U.S. residents and also to U.S. citizens and green card holders residing in other countries.

W

WThe Foreign Investment in Real Property Tax Act of 1980 (FIRPTA), enacted as Subtitle C of Title XI of the Omnibus Reconciliation Act of 1980, Pub. L. No. 96-499, 94 Stat. 2599, 2682, is a United States tax law that imposes income tax on foreign persons disposing of US real property interests. Tax is imposed at regular tax rates for the taxpayer on the amount of gain considered recognized. Purchasers of real property interests are required to withhold tax on payment for the property. Withholding may be reduced from the standard 15% to an amount that will cover the tax liability, upon application in advance of sale to the Internal Revenue Service. FIRPTA overrides most nonrecognition provisions as well as those remaining tax treaties that provide exemption from tax for such gains.

W

WThe Harrison Narcotics Tax Act was a United States federal law that regulated and taxed the production, importation, and distribution of opiates and coca products. The act was proposed by Representative Francis Burton Harrison of New York and was approved on December 17, 1914.

W

WThe Internal Revenue Service Restructuring and Reform Act of 1998, also known as Taxpayer Bill of Rights III,, resulted from hearings held by the United States Congress in 1996 and 1997. The Act included numerous amendments to the Internal Revenue Code of 1986.

W

WThe Jobs and Growth Tax Relief Reconciliation Act of 2003, was passed by the United States Congress on May 23, 2003 and signed into law by President George W. Bush on May 28, 2003. Nearly all of the cuts were set to expire after 2010.

W

WThe Marihuana Tax Act of 1937, Pub.L. 75–238, 50 Stat. 551, enacted August 2, 1937, was a United States Act that placed a tax on the sale of cannabis. The H.R. 6385 act was drafted by Harry Anslinger and introduced by Rep. Robert L. Doughton of North Carolina, on April 14, 1937. The Seventy-fifth United States Congress held hearings on April 27, 28, 29th, 30th, and May 4, 1937. Upon the congressional hearings confirmation, the H.R. 6385 act was redrafted as H.R. 6906 and introduced with House Report 792. The Act is now commonly referred to, using the modern spelling, as the 1937 Marijuana Tax Act. This act was overturned in 1969 in Leary v. United States, and was repealed by Congress the next year.

W

WThe Omnibus Budget Reconciliation Act of 1990 is a United States statute enacted pursuant to the budget reconciliation process to reduce the United States federal budget deficit. The Act included the Budget Enforcement Act of 1990 which established the "pay-as-you-go" or "PAYGO" process for discretionary spending and taxes.

W

WThe Omnibus Budget Reconciliation Act of 1993 was a federal law that was enacted by the 103rd United States Congress and signed into law by President Bill Clinton. It has also been unofficially referred to as the Deficit Reduction Act of 1993. Part XIII of the law is also called the Revenue Reconciliation Act of 1993.

W

WThe Omnibus Foreign Trade and Competitiveness Act of 1988 is an act passed by the United States Congress and signed into law by President Ronald Reagan.

W

WThe Payne–Aldrich Tariff Act of 1909, named for Representative Sereno E. Payne (R–NY) and Senator Nelson W. Aldrich (R–RI), began in the United States House of Representatives as a bill raising certain tariffs on goods entering the United States. The high rates angered Republican reformers, and led to a deep split in the Republican Party.

W

WThe Philippines Charitable Giving Assistance Act allowed Americans to retroactively claim tax deductions for charitable donations made between January 1, 2014 and April 15, 2014 as donations made in the year 2013, which were made for the relief of victims of Typhoon Haiyan in the Philippines and nearby areas, after the Federal Trade Commission and State of Hawaii Department of Commerce and Consumer Affairs published advisories concerning Typhoon Haiyan charity scams. Under the law, the Internal Revenue Service accepted phone bills in lieu of documentation from 501(c)3 organizations for those donations made for the relief of victims of the typhoon. The typhoon did an estimated $1 billion in damage and killed thousands of people.

W

WPublic Law 110-343 is a US Act of Congress signed into law by U.S. President George W. Bush, which was designed to mitigate the growing financial crisis of the late-2000s by giving relief to so-called "Troubled Assets."

W

WThe Revenue Act of 1913, also known as the Underwood Tariff or the Underwood-Simmons Act, re-established a federal income tax in the United States and substantially lowered tariff rates. The act was sponsored by Representative Oscar Underwood, passed by the 63rd United States Congress, and signed into law by President Woodrow Wilson.

W

WThe United States Revenue Act of 1924, also known as the Mellon tax bill cut federal tax rates and established the U.S. Board of Tax Appeals, which was later renamed the United States Tax Court in 1942. The bill was named after U.S. Secretary of the Treasury Andrew Mellon.

W

WThe United States Revenue Act of 1926, 44 Stat. 9, reduced inheritance and personal income taxes, cancelled many excise imposts, eliminated the gift tax and ended public access to federal income tax returns.

W

WThe United States 'Revenue and Expenditure Control Act of 1968 created a temporary 10 percent income tax surcharge on both individuals and corporations through June 30, 1969 to help pay for the Vietnam War. It also delayed the scheduled reduction in the telephone and automobile excise tax, causing them to end in 1973 instead of 1969. It was signed into law by President Lyndon Johnson on June 28, 1968.

W

WThe Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019, Pub.L. 116–94 (text) (pdf), was signed into law by President Donald Trump on December 20, 2019 as part of the Further Consolidated Appropriations Act, 2020.

W

WThe Small Business Jobs Act of 2010 is a federal law passed by the 111th United States Congress and signed into law by President Barack Obama on September 27, 2010. The law authorizes the creation of the Small Business Lending Fund Program administered by the Treasury Department to make capital investments in eligible institutions, in order to increase the availability of credit for small businesses.

W

WThe Tariff Act of 1930, commonly known as the Smoot–Hawley Tariff or Hawley–Smoot Tariff, was a law that implemented protectionist trade policies in the United States. Sponsored by Senator Reed Smoot and Representative Willis C. Hawley, it was signed by President Herbert Hoover on June 17, 1930. The act raised US tariffs on over 20,000 imported goods.

W

WTariff of 1791 or Excise Whiskey Tax of 1791 was a United States statute establishing a taxation policy to further reduce Colonial America public debt as assumed by the residuals of American Revolution. The Act of Congress imposed duties or tariffs on domestic and imported distilled spirits generating government revenue while fortifying the Federalist Era.

W

WThe Tariff of 1792 was the third of Alexander Hamilton's protective tariffs in the United States. Hamilton had persuaded the United States Congress to raise duties slightly in 1790, and he persuaded them to raise rates again in 1792, although still not to his satisfaction. Protectionism was one of the fulfillments of Hamilton's Report on Manufactures.

W

WThe Tariff of 1833, enacted on March 2, 1833, was proposed by Henry Clay and John C. Calhoun as a resolution to the Nullification Crisis. Enacted under Andrew Jackson's presidency, it was adopted to gradually reduce the rates following Southerners' objections to the protectionism found in the Tariff of 1832 and the 1828 Tariff of Abominations; the tariffs had prompted South Carolina to threaten secession from the Union. This Act stipulated that import taxes would gradually be cut over the next decade until, by 1842, they matched the levels set in the Tariff of 1816—an average of 20%. The compromise reductions lasted only two months into their final stage before protectionism was reinstated by the Black Tariff of 1842.

W

WThe Tax Cuts and Jobs Act of 2017 (TCJA) is a congressional revenue act of the United States signed into law by President Donald Trump which amended the Internal Revenue Code of 1986. Major elements of the changes include reducing tax rates for businesses and individuals, increasing the standard deduction and family tax credits, eliminating personal exemptions and making it less beneficial to itemize deductions, limiting deductions for state and local income taxes and property taxes, further limiting the mortgage interest deduction, reducing the alternative minimum tax for individuals and eliminating it for corporations, reducing the number of estates impacted by the estate tax, and cancelling the penalty enforcing individual mandate of the Affordable Care Act (ACA).

W

WThe Tax Equity and Fiscal Responsibility Act of 1982, also known as TEFRA, is a United States federal law that rescinded some of the effects of the Kemp-Roth Act passed the year before. Between summer 1981 and summer 1982, tax revenue fell by about 6% in real terms, caused by the dual effects of the economy dipping back into recession and Kemp-Roth's reduction in tax rates, and the deficit was likewise rising rapidly because of the fall in revenue, and the rise in government expenditures. The rapid rise in the budget deficit created concern among many in Congress. TEFRA was created in order to reduce the budget gap by generating revenue through closure of tax loopholes, introduction of tougher enforcement of tax rules, rescinding some of Kemp-Roth's reductions in marginal personal income tax rates that had not yet gone into effect, and raising some rates, especially corporate rates. TEFRA was introduced November 13, 1981 and was sponsored by Representative Pete Stark of California. After much deliberation, the final version was signed by President Ronald Reagan on September 3, 1982.

W

WThe United States Tax Reduction Act of 1975 provided a 10-percent rebate on 1974 tax liability. It created a temporary $30 general tax credit for each taxpayer and dependent.

W

WThe Tax Reduction and Simplification Act of 1977 was passed by the 95th United States Congress and signed into law by President Jimmy Carter on May 23, 1977.

W

WThe Tax Reform Act of 1986 (TRA) was passed by the 99th United States Congress and signed into law by President Ronald Reagan on October 22, 1986.

W

WThe Tax Relief and Health Care Act of 2006, includes a package of tax extenders, provisions affecting health savings accounts and other provisions in the United States.

W

WThe Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010, also known as the 2010 Tax Relief Act, was passed by the United States Congress on December 16, 2010, and signed into law by President Barack Obama on December 17, 2010.

W

WThe Taxpayer First Act is a law that makes significant reforms to the Internal Revenue Service (IRS).

W

WThe Taxpayer Relief Act of 1997 reduced several federal taxes in the United States.

W

WThe Committee on Ways and Means is the chief tax-writing committee of the United States House of Representatives. The committee has jurisdiction over all taxation, tariffs, and other revenue-raising measures, as well as a number of other programs including Social Security, unemployment benefits, Medicare, the enforcement of child support laws, Temporary Assistance for Needy Families, foster care, and adoption programs. Members of the Ways and Means Committee are not allowed to serve on any other House Committee unless they are granted a waiver from their party's congressional leadership. It has long been regarded as the most prestigious committee of the House of Representatives.

W

WThe War Revenue Act of 1898 was legislation signed into law in the United States on June 13, 1898, which created a wide range of taxes to raise revenue for the American prosecution of the Spanish–American War. The legislation established the predecessor to the estate tax, and twice the Supreme Court of the United States issued rulings about the law.

W

WThe Whiskey Rebellion was a violent tax protest in the United States beginning in 1791 and ending in 1794 during the presidency of George Washington, ultimately under the command of American Revolutionary War veteran Major James McFarlane. The so-called "whiskey tax" was the first tax imposed on a domestic product by the newly formed federal government. Beer was difficult to transport and spoiled more easily than rum and whiskey. Rum distillation in the United States had been disrupted during the Revolutionary War, and whiskey distribution and consumption increased after the Revolutionary War. The "whiskey tax" became law in 1791, and was intended to generate revenue for the war debt incurred during the Revolutionary War. The tax applied to all distilled spirits, but consumption of American whiskey was rapidly expanding in the late 18th century, so the excise became widely known as a "whiskey tax". Farmers of the western frontier were accustomed to distilling their surplus rye, barley, wheat, corn, or fermented grain mixtures to make whiskey. These farmers resisted the tax. In these regions, whiskey often served as a medium of exchange. Many of the resisters were war veterans who believed that they were fighting for the principles of the American Revolution, in particular against taxation without local representation, while the federal government maintained that the taxes were the legal expression of Congressional taxation powers.

W

WThe Revenue Act or Wilson-Gorman Tariff of 1894 slightly reduced the United States tariff rates from the numbers set in the 1890 McKinley tariff and imposed a 2% tax on income over $4,000. It is named for William L. Wilson, Representative from West Virginia, chair of the U.S. House Ways and Means Committee, and Senator Arthur P. Gorman of Maryland, both Democrats.