W

WIn management accounting or managerial accounting, managers use accounting information in decision-making and to assist in the management and performance of their control functions.

W

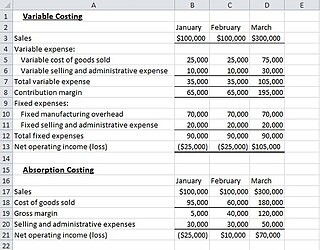

WVariable costing is a managerial accounting cost concept. Under this method, manufacturing overhead is incurred in the period that a product is produced. This addresses the issue of absorption costing that allows income to rise as production rises. Under an absorption cost method, management can push forward costs to the next period when products are sold. This artificially inflates profits in the period of production by incurring less cost than would be incurred under a variable costing system. Variable costing is generally not used for external reporting purposes. Under the Tax Reform Act of 1986, income statements must use absorption costing to comply with GAAP.

W

WActivity-based costing (ABC) is a costing method that identifies activities in an organization and assigns the cost of each activity to all products and services according to the actual consumption by each. Therefore this model assigns more indirect costs (overhead) into direct costs compared to conventional costing.

W

WUnder the 'average cost method', it is assumed that the cost of inventory is based on the average cost of the goods available for sale during the period.

W

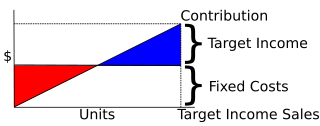

WThe break-even point (BEP) in economics, business—and specifically cost accounting—is the point at which total cost and total revenue are equal, i.e. "even". There is no net loss or gain, and one has "broken even", though opportunity costs have been paid and capital has received the risk-adjusted, expected return. In short, all costs that must be paid are paid, and there is neither profit or loss.

W

WCash flow forecasting is the process of obtaining an estimate or forecast of a company's future financial position; the cash flow forecast is typically based on anticipated payments and receivables. See Financial forecast for general discussion re methodology.

W

WCertified Management Accountant (CMA) is a professional certification credential in the management accounting and financial management fields. The certification signifies that the person possesses knowledge in the areas of financial planning, analysis, control, decision support, and professional ethics. There are many professional bodies globally that have management accounting professional qualifications. The main bodies that offer the CMA certification are:Institute of Management Accountants USA; Institute of Certified Management Accountants (Australia); and Certified Management Accountants of Canada.

W

WThe Chartered Institute of Management Accountants (CIMA) is the global professional management accounting body based out of the UK. CIMA offers training and qualification in management accountancy and related subjects. It is focused on accountants working in the industry and provides ongoing support and training for members.

W

WContribution margin (CM), or dollar contribution per unit, is the selling price per unit minus the variable cost per unit. "Contribution" represents the portion of sales revenue that is not consumed by variable costs and so contributes to the coverage of fixed costs. This concept is one of the key building blocks of break-even analysis.

W

WCost accounting is defined as "a systematic set of procedures for recording and reporting measurements of the cost of manufacturing goods and performing services in the aggregate and in detail. It includes methods for recognizing, classifying, allocating, aggregating and reporting such costs and comparing them with standard costs." (IMA) Often considered a subset of managerial accounting, its end goal is to advise the management on how to optimize business practices and processes based on cost efficiency and capability. Cost accounting provides the detailed cost information that management needs to control current operations and plan for the future.

W

WCost–volume–profit (CVP), in managerial economics, is a form of cost accounting. It is a simplified model, useful for elementary instruction and for short-run decisions.

W

WChartered Professional Accountants of Canada is the national organization representing the Canadian accounting profession through the unification of the three largest accounting organizations: the Canadian Institute of Chartered Accountants (CICA), the Society of Management Accountants of Canada and Certified General Accountants of Canada (CGA-Canada), as well as the 40 national and provincial accounting bodies. It is one of the largest organizations of its type in the world, with over 217,000 Chartered Professional Accountants in Canada and around the world.

W

WEarnings management, in accounting, is the act of intentionally influencing the process of financial reporting to obtain some private gain. Earnings management involves the alteration of financial reports to mislead stakeholders about the organization's underlying performance, or to "influence contractual outcomes that depend on reported accounting numbers."

W

WEntity-level controls are internal controls that help to ensure that management directives pertaining to the entire entity are carried out. They are the second level of a top-down approach to understanding the risks of an organization. Generally, entity refers to the entire company.

W

WFinancial statement analysis is the process of reviewing and analyzing a company's financial statements to make better economic decisions to earn income in future. These statements include the income statement, balance sheet, statement of cash flows, notes to accounts and a statement of changes in equity. Financial statement analysis is a method or process involving specific techniques for evaluating risks, performance, financial health, and future prospects of an organization.

W

WIn accounting and economics, fixed costs, also known as indirect costs or overhead costs, are business expenses that are not dependent on the level of goods or services produced by the business. They tend to be recurring, such as interest or rents being paid per month. This is in contrast to variable costs, which are volume-related and unknown at the beginning of the accounting year.

W

WGross margin is the difference between revenue and cost of goods sold (COGS), divided by revenue. Gross margin is expressed as a percentage. Generally, it is calculated as the selling price of an item, less the cost of goods sold, then divided by the same selling price. "Gross margin" is often used interchangeably with "gross profit", however the terms are different: "gross profit" is technically an absolute monetary amount and "gross margin" is technically a percentage or ratio.

W

WThe Institute of Certified Management Accountants of Sri Lanka, is a professional body offering qualification in management accountancy in Sri Lanka.

W

WThe Institute of Cost and Management Accountants of Bangladesh (ICMAB) is an institution dedicated to Cost and Management Accounting education and research in Bangladesh. It is managed as an autonomous professional body under the Ministry of Commerce. As well as education, it is also engaged in regulating and promoting the profession of cost and management accountant in Bangladesh.

W

WThe Institute of Management Accountants (IMA), formerly known as the National Association of Cost Accountants (NACA), is a professional organization of accountants.

W

WIn accounting, the inventory turnover is a measure of the number of times inventory is sold or used in a time period such as a year. It is calculated to see if a business has an excessive inventory in comparison to its sales level. The equation for inventory turnover equals the cost of goods sold divided by the average inventory. Inventory turnover is also known as inventory turns, merchandise turnover, stockturn, stock turns, turns, and stock turnover.

W

WManagement accounting principles (MAP) were developed to serve the core needs of internal management to improve decision support objectives, internal business processes, resource application, customer value, and capacity utilization needed to achieve corporate goals in an optimal manner. Another term often used for management accounting principles for these purposes is managerial costing principles. The two management accounting principles are:Principle of Causality and, Principle of Analogy.

W

WA management control system (MCS) is a system which gathers and uses information to evaluate the performance of different organizational resources like human, physical, financial and also the organization as a whole in light of the organizational strategies pursued.

W

WThe Morris–Putnam point is the point within a break even analysis where an algorithmic trend line indicates break even will be exceeded by n percent. Economists and Financial analysts use the Morris–Putnam point to predict the impact of commodities costs on juice and heavy metals profits. Meteorologists use "The Point" to forecast dew points and localized wind gusts. Sales people use the point to rationalize the addition of ‘fees’ to previously agreed upon prices because when modeled skillfully, the Morris–Putnam point almost always predicts future success.

W

WIn cost accounting, profitability analysis is an analysis of the profitability of an organisation's output. Output of an organisation can be grouped into products, customers, locations, channels and/or transactions.

W

WRCA Open-Source Application (ROSA) is an open-source management accounting application that aims to provide decision support information to managers. Resource consumption accounting (RCA) is a principle-based approach to management accounting that combines German management accounting techniques known as Grenzplankostenrechnung (GPK) with a disciplined form of activity-based costing.

W

WA relevant cost is a cost that differs between alternatives being considered. In order for a cost to be a relevant cost it must be:Future Cash Flow Incremental

W

WIn cost accounting, target income sales are the sales necessary to achieve a given target income. It can be measured either in units or in currency, and can be computed using contribution margin similarly to break-even point:

W

WThroughput accounting (TA) is a principle-based and simplified management accounting approach that provides managers with decision support information for enterprise profitability improvement. TA is relatively new in management accounting. It is an approach that identifies factors that limit an organization from reaching its goal, and then focuses on simple measures that drive behavior in key areas towards reaching organizational goals. TA was proposed by Eliyahu M. Goldratt as an alternative to traditional cost accounting. As such, Throughput Accounting is neither cost accounting nor costing because it is cash focused and does not allocate all costs to products and services sold or provided by an enterprise. Considering the laws of variation, only costs that vary totally with units of output e.g. raw materials, are allocated to products and services which are deducted from sales to determine Throughput. Throughput Accounting is a management accounting technique used as the performance measure in the Theory of Constraints (TOC). It is the business intelligence used for maximizing profits, however, unlike cost accounting that primarily focuses on 'cutting costs' and reducing expenses to make a profit, Throughput Accounting primarily focuses on generating more throughput. Conceptually, Throughput Accounting seeks to increase the speed or rate at which throughput is generated by products and services with respect to an organization's constraint, whether the constraint is internal or external to the organization. Throughput Accounting is the only management accounting methodology that considers constraints as factors limiting the performance of organizations.

W

WVariable costs are costs that change as the quantity of the good or service that a business produces changes. Variable costs are the sum of marginal costs over all units produced. They can also be considered normal costs. Fixed costs and variable costs make up the two components of total cost. Direct costs are costs that can easily be associated with a particular cost object. However, not all variable costs are direct costs. For example, variable manufacturing overhead costs are variable costs that are indirect costs, not direct costs. Variable costs are sometimes called unit-level costs as they vary with the number of units produced.