W

WThe United States federal budget comprises the spending and revenues of the U.S. federal government. The budget is the financial representation of the priorities of the government, reflecting historical debates and competing economic philosophies. The government primarily spends on healthcare, retirement, and defense programs. The non-partisan Congressional Budget Office provides extensive analysis of the budget and its economic effects. It has reported that large budget deficits over the next 30 years are projected to drive federal debt held by the public to unprecedented levels—from 98 percent of gross domestic product (GDP) in 2020 to 195 percent by 2050.

W

WThe American Taxpayer Relief Act of 2012 was enacted and was passed by the United States Congress on January 2, 2013, and was signed into law by US President Barack Obama the next day.

W

WThe Bipartisan Budget Act of 2013 is a federal statute concerning spending and the budget in the United States, that was signed into law by President Barack Obama on December 26, 2013. On December 10, 2013, pursuant to the provisions of the Continuing Appropriations Act, 2014 calling for a joint budget conference to work on possible compromises, Representative Paul Ryan and Senator Patty Murray announced a compromise that they had agreed to after extended discussions between them. The law raises the sequestration caps for fiscal years 2014 and 2015, in return for extending the imposition of the caps into 2022 and 2023, and miscellaneous savings elsewhere in the budget. Overall, the bill is projected to lower the deficit by $23 billion over the long term.

W

WThe Bipartisan Budget Act of 2018 is a federal statute concerning spending and the budget in the United States, that was signed into law by President Donald Trump on February 9, 2018. Delays in the passage of the bill caused a nine-hour funding gap. The bill is the third in a series that increased spending caps originally imposed by the Budget Control Act of 2011; the first two were the Bipartisan Budget Act of 2013 and the Bipartisan Budget Act of 2015.

W

WThe Budget and Accounting Act of 1921 was landmark legislation that established the framework for the modern federal budget. The act was approved by President Warren G. Harding to provide a national budget system and an independent audit of government accounts. The official title of this act is "The General Accounting Act of 1921", but is frequently referred to as "the budget act", or "the Budget and Accounting Act". This act meant that for the first time, the president would be required to submit an annual budget for the entire federal government to Congress. The object of the budget bill was to consolidate the spending agencies in both the executive and legislative branches of the government.

W

WThe Budget Control Act of 2011 is a federal statute enacted by the 112th United States Congress and signed into law by US President Barack Obama on August 2, 2011. The Act brought conclusion to the 2011 US debt-ceiling crisis.

W

WThe Congressional Budget and Impoundment Control Act of 1974 is a United States federal law that governs the role of the Congress in the United States budget process.

W

WThe Congressional Budget Office (CBO) is a federal agency within the legislative branch of the United States government that provides budget and economic information to Congress. Inspired by California's Legislative Analyst's Office that manages the state budget in a strictly nonpartisan fashion, the CBO was created as a nonpartisan agency by the Congressional Budget and Impoundment Control Act of 1974.

W

WEach year the United States Congress passes a Federal Budget detailing where federal tax money will be spent in the coming fiscal year. The budget is broken down into various Budget Activity Groups (BAG). Below is a breakdown of the Defense Health Program (DHP) Budget Activity Group.

W

WDeficit reduction in the United States refers to taxation, spending, and economic policy debates and proposals designed to reduce the Federal budget deficit. Government agencies including the Government Accountability Office (GAO), Congressional Budget Office (CBO), the Office of Management and Budget (OMB),and the U.S. Treasury Department have reported that the federal government is facing a series of important long-run financing challenges, mainly driven by an aging population, rising healthcare costs per person, and rising interest payments on the national debt.

W

WThe executive budget is the budget for the executive branch of the United States government. It was established as one of the reforms during the Progressive Era and became a federal policy in 1921 under the Woodrow Wilson Administration. The process of creating the executive budget consists of three phases. The first stage is the development of the president's budget. In this stage, the president submits a comprehensive budget to the United States Congress that covers the full range of federal activities. Next, the budget proposal is edited and revised by Congress. Last, the budget is finalized and executed. It is then given a budget bill from the legislature. The legislature composes the budget bill while an executive agency implements the bill by choosing which projects to take on within the limitations imposed.

W

WThe financial position of the United States includes assets of at least $269.6 trillion and debts of $145.8 trillion to produce a net worth of at least $123.8 trillion as of Q1 2014.

W

WThe Golden Fleece Award (1975–1988) was a tongue-in-cheek award given to public officials in the United States for their squandering of public money, its name sardonically purloined from the actual Order of the Golden Fleece, a prestigious chivalric award created in the late-15th Century, and a play on the transitive verb fleece, as in charging excessively for goods or services. United States Senator William Proxmire, a Democrat from Wisconsin, began to issue the Golden Fleece Award in 1975 in monthly press releases. The Washington Post once referred to the award as "the most successful public relations device in politics today". Senator Robert Byrd of West Virginia, referred to the award as being "as much a part of the Senate as quorum calls and filibusters".

W

WThe United States House Committee on Appropriations is a committee of the United States House of Representatives that is responsible for passing appropriation bills along with its Senate counterpart. The bills passed by the Appropriations Committee regulate expenditures of money by the government of the United States. As such, it is one of the most powerful of the committees, and its members are seen as influential. They make the key decisions about the work of their committees—when their committees meet, which bills they will consider, and for how long.

W

WI.O.U.S.A. is a 2008 American documentary film directed by Patrick Creadon. The film focuses on the shape and impact of the United States national debt. The film features Robert Bixby, director of the Concord Coalition, and David Walker, the former U.S. Comptroller General, as they travel around the United States on a tour to let communities know of the potential dangers of the national debt. The tour was carried out through the Concord Coalition, and was known as the "Fiscal Wake-Up Tour."

W

WThe military budget is the largest portion of the discretionary United States federal budget allocated to the Department of Defense, or more broadly, the portion of the budget that goes to any military-related expenditures. The military budget pays the salaries, training, and health care of uniformed and civilian personnel, maintains arms, equipment and facilities, funds operations, and develops and buys new items. The budget funds five branches of the U.S. military: the Army, Navy, Marine Corps, Air Force, and Space Force.

W

WThe prime mission of a project is activities in the period of operation proposed by NASA when it was selected for funding. The United States Congress passes a budget detailing where Federal tax money is to be spent in the upcoming year. The budget includes funding for NASA, sometimes with explicit instructions on how to allocate money to the project level, based on NASA's recommendations. The duration of a project may vastly exceed the prime mission, and money spent on a project during its lifetime may vastly exceed the original budget.

W

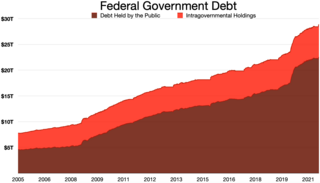

WThe national debt of the United States is the total national debt owed by the federal government of the United States to Treasury security holders. The national debt at any point in time is the face value of the then outstanding Treasury securities that have been issued by the Treasury and other federal government agencies. The terms "national deficit" and "national surplus" usually refer to the federal government budget balance from year to year, not the cumulative amount of debt. In a deficit year the national debt increases as the government needs to borrow funds to finance the deficit, while in a surplus year the debt decreases as more money is received than spent, enabling the government to reduce the debt by buying back some Treasury securities. In general, government debt increases as a result of government spending and decreases from tax or other receipts, both of which fluctuate during the course of a fiscal year. There are two components of gross national debt:"Debt held by the public" – such as Treasury securities held by investors outside the federal government, including those held by individuals, corporations, the Federal Reserve, and foreign, state and local governments. "Debt held by government accounts" or "intragovernmental debt" – is non-marketable Treasury securities held in accounts of programs administered by the federal government, such as the Social Security Trust Fund. Debt held by government accounts represents the cumulative surpluses, including interest earnings, of various government programs that have been invested in Treasury securities.

W

WThe Office of Management and Budget (OMB) is the largest office within the Executive Office of the President of the United States (EOP). OMB's most prominent function is to produce the president's budget, but it also examines agency programs, policies, and procedures to see whether they comply with the president's policies and coordinates inter-agency policy initiatives.

W

WThe Path to Prosperity: Restoring America's Promise was the Republican Party's budget proposal for the Federal government of the United States in the fiscal year 2012. It was succeeded in March 2012 by "The Path to Prosperity: A Blueprint for American Renewal", the Republican budget proposal for 2013. Representative Paul Ryan, Chairman of the House Budget Committee, played a prominent public role in drafting and promoting both The Path to Prosperity proposals, and they are therefore often referred to as the Ryan budget, Ryan plan or Ryan proposal.

W

WLong considered a sacred cow of American defense spending, U.S. federal military bands have periodically faced the prospect of decreased allocations in military budgets in proposals occasionally floated by lawmakers of the U.S. Democratic and Republican parties. Defunding efforts have generally been opposed by military leadership, veteran's groups, and music educators, and have largely been unsuccessful and short-lived.

W

WReaganomics, or Reaganism, refers to the neoliberal economic policies promoted by U.S. President Ronald Reagan during the 1980s. These policies are commonly associated with and characterized as supply-side economics, trickle-down economics, or voodoo economics by opponents, while Reagan and his advocates preferred to call it free-market economics.

W

WThe United States Senate Committee on Appropriations is a standing committee of the United States Senate. It has jurisdiction over all discretionary spending legislation in the Senate.

W

WThe United States Senate Committee on the Budget was established by the Congressional Budget and Impoundment Control Act of 1974. It is responsible for drafting Congress's annual budget plan and monitoring action on the budget for the Federal Government. The committee has jurisdiction over the Congressional Budget Office. The committee briefly operated as a special committee from 1919 to 1920 during the 66th Congress, before being made a standing committee in 1974.

W

W"Starving the beast" is a political strategy employed by American conservatives to limit government spending by cutting taxes, in order to deprive the federal government of revenue in a deliberate effort to force it to reduce spending. The term "the beast", in this context, refers to the United States Federal Government and the programs it funds, using mainly American taxpayer dollars, particularly social programs such as education, welfare, Social Security, Medicare, and Medicaid.

W

WThe United States Innovation and Competition Act of 2021 (USICA), formerly known as the Endless Frontier Act, is United States legislation sponsored by Senators Chuck Schumer (D-NY) and Todd Young (R-IN) authorizing $110 billion for basic and advanced technology research over a five year period. Investment in basic and advanced research, commercialization, and education and training programs in artificial intelligence, semiconductors, quantum computing, advanced communications, biotechnology and advanced energy, amounts to $100 billion. Over $10 billion was authorized for appropriation to designate ten regional technology hubs and create a supply chain crisis-response program. The act is aimed at competing with China and to respond to US fears of an AI Cold War.

W

WThe United States intelligence budget comprises all the funding for the 16 agencies of the United States Intelligence Community. These agencies and other programs fit into one of the intelligence budget's two components, the National Intelligence Program (NIP) and the Military Intelligence Program (MIP). As with other parts of the federal budget, the US intelligence budget runs according to the Fiscal year (FY), not the calendar year. Before government finances are spent on intelligence, the funds must first be authorized and appropriated by committees in both the United States House of Representatives and the United States Senate.