W

W1Malaysia Development Berhad is an insolvent Malaysian strategic development company, wholly owned by the Minister of Finance (Incorporated).

W

WThe 2008 Liechtenstein tax affair is a series of tax investigations in numerous countries whose governments suspect that some of their citizens may have evaded tax obligations by using banks and trusts in Liechtenstein; the affair broke open with the biggest complex of investigations ever initiated for tax evasion in the Federal Republic of Germany. It is seen also as an attempt to put pressure on Liechtenstein, one of the remaining uncooperative tax havens, as identified by the Financial Action Task Force (FATF) on Money Laundering of the Paris-based Organisation for Economic Co-operation and Development, along with Andorra and Monaco, in 2007.

W

WThe 2011 UBS rogue trader scandal caused a loss of over US$2 billion at Swiss bank UBS, as a result of unauthorized trading performed by Kweku Adoboli, a director of the bank's Global Synthetic Equities Trading team in London in early September 2011.

W

WAmir Bramly is an Israeli investor and business man convicted of money laundering and fraud. He is the founder and former manager of Rubicon Business Group and "Kela Fund", and former partner in Hagshama fund. At the height of his career, Bramly controlled dozens of companies, and received intense media coverage both of his own dealings and as an interviewed expert.

W

WThe CumEx-Files is an investigation by a number of European news media outlets into a tax fraud scheme discovered by them in 2017. A network of banks, stock traders, and lawyers had obtained billions from European treasuries through suspected fraud and speculation involving dividend taxes. The five hardest hit countries may have lost at least $62.9 billion. Germany is the hardest hit country, with around $36.2 billion withdrawn from the German treasury. Estimated losses for other countries include at least €17 billion for France, €4.5 billion in Italy, €1.7 billion in Denmark and €201 million for Belgium.

W

WThe Danske Bank money laundering scandal arose in 2017-2018, when it became known that around €200 billion of suspicious transactions had flowed from Estonian, Russian, Latvian and other sources through the Estonia-based bank branch of Denmark-based Danske Bank from 2007 to 2015. It has been described as possibly the largest money laundering scandal ever in Europe, and as possibly the largest in world history. It includes incoming funds from Estonia (23%), Russia (23%), Latvia (12%), Cyprus (9%), UK (4%) and others. Outgoing funds were distributed between Estonia (15%), Latvia (14%), China (7%), Switzerland (6%), Turkey (6%) and others (52%)

W

WThe Evergrande liquidity crisis refers to the ongoing financial situation of Chinese property developer Evergrande Group. After a letter circulated online of the company informing the Guangdong government that it was at risk of a cash crunch, shares in the company have plunged in value, with impacts on global markets and a significant slow-down in foreign investment in China during August to October of 2021.

W

WThe Galleon Group was one of the largest hedge fund management firms in the world, managing over $7 billion, before closing in October 2009. The firm was the center of a 2009 insider trading scandal which subsequently led to its fall.

W

WRajat Kumar Gupta is an Indian-American businessman and convicted felon who, as CEO, was the first foreign-born managing director of management consultancy firm McKinsey & Company from 1994 to 2003. In 2012, he was convicted for insider trading and spent two years in jail. Gupta was a board member of corporations including Goldman Sachs, Procter & Gamble and American Airlines, and an advisor to non-profits such as the Bill & Melinda Gates Foundation and The Global Fund to Fight AIDS, Tuberculosis and Malaria. He is the co-founder of the Indian School of Business, American India Foundation, New Silk Route and Scandent Solutions.

W

WThe Institute for the Works of Religion, commonly known as the Vatican Bank, is a financial institution situated inside Vatican City and run by a Board of Superintendence which reports to a Commission of Cardinals and the Pope. It is not a private bank, as there are no owners or shareholders, but it has been established in the form of a juridical canonical foundation, pursuant to its Statutes. Since 9 July 2014, its President is Jean-Baptiste de Franssu. The IOR is regulated by the Vatican's financial supervisory body AIF.

W

WLuxembourg Leaks is the name of a financial scandal revealed in November 2014 by a journalistic investigation conducted by the International Consortium of Investigative Journalists. It is based on confidential information about Luxembourg's tax rulings set up by PricewaterhouseCoopers from 2002 to 2010 to the benefits of its clients. This investigation resulted in making available to the public tax rulings for over three hundred multinational companies based in Luxembourg.

W

WBernard Lawrence Madoff was an American fraudster and financier who ran the largest Ponzi scheme in history, worth about $64.8 billion. He was at one time chairman of the NASDAQ stock exchange. He advanced the proliferation of electronic trading platforms and the concept of payment for order flow, which has been described as a "legal kickback".

W

WMansion House is the official residence of the Lord Mayor of London. It is a Grade I listed building.

W

WThe Higher Education Student Assistance Authority (HESAA) is a New Jersey State chartered-loan program, charged with providing student loan financing programs. It has received criticism in the New York Times for what the paper called its "extraordinarily stringent rules".

W

WThe Panama Papers are 11.5 million leaked documents that were published beginning on April 3, 2016. The papers detail financial and attorney–client information for more than 214,488 offshore entities. The documents, some dating back to the 1970s, were created by, and taken from, former Panamanian offshore law firm and corporate service provider Mossack Fonseca.

W

WThe Pandora Papers are 11.9 million leaked documents with 2.9 terabytes of data that the International Consortium of Investigative Journalists (ICIJ) published beginning on 3 October 2021. The leak exposed the secret offshore accounts of 35 world leaders, including current and former presidents, prime ministers, and heads of state as well as more than 100 billionaires, celebrities, and business leaders. The news organizations of the ICIJ described the document leak as their most expansive exposé of financial secrecy yet, containing documents, images, emails and spreadsheets from 14 financial service companies, in nations including Panama, Switzerland and the United Arab Emirates, surpassing their previous release of the Panama Papers in 2016, which had 11.5 million confidential documents. At the time of the release of the papers, the ICIJ said it is not identifying its source for the documents.

W

WThe Renewable Heat Incentive scandal, also referred to as RHIgate and the Cash for Ash scandal, is a political scandal in Northern Ireland that centres on a failed renewable energy incentive scheme that has been reported to potentially cost the public purse almost £500 million. The plan, initiated in 2012, was overseen by Arlene Foster of the Democratic Unionist Party (DUP), the then-Minister for Enterprise, Trade and Investment. Foster failed to introduce proper cost controls, allowing the plan to spiral out of control. The scheme worked by paying applicants to use renewable energy. However, the rate paid was more than the cost of the fuel, and thus many applicants were making profits simply by heating their properties.

W

WThe sale of UK gold reserves was a policy pursued by HM Treasury over the period between 1999 and 2002, when gold prices were at their lowest in 20 years, following an extended bear market. The period itself has been dubbed by some commentators as the Brown Bottom or Brown's Bottom.

W

WThe Saradha Group financial scandal was a major financial scam and alleged political scandal caused by the collapse of a Ponzi scheme run by Saradha Group, a consortium of over 200 private companies that was believed to be running collective investment schemes popularly but incorrectly referred to as chit funds in Eastern India.

W

WSEC v. Rajaratnam, 622 F.3d 159, is a United States Court of Appeals for the Second Circuit case in which defendants Raj Rajaratnam and Danielle Chiesi appealed a discovery order issued by a district court during a civil trial against them for insider trading filed by the Securities and Exchange Commission (SEC). The district court compelled the defendants to disclose to the SEC the contents of thousands of wiretapped conversations that were originally obtained by the United States Attorney's Office (USAO) and were turned over to the defendants during a separate criminal trial.

W

WSpotOption was a privately held platform software provider based in Israel in the controversial binary option industry, which was banned in Israel starting in January 2018. The firm announced that it has left the binary options business and is exploring other possibilities. It had previously announced a downsizing of its operations in Israel and moving many functions to other locations. The firm claimed to have 70 percent share in the market for binary options platforms, and charged binary options firms up to 12.5% of their revenues.

W

WThe State Reserves Bureau Copper Scandal refers to a loss of approximately US$150 million as a result of trading LME Copper futures contracts at the London Metal Exchange (LME) by rogue trader Liu Qibing, who was the chief trader for the Import and Export Department of the State Regulation Centre for Supply Reserves (SRCSR), the trading agency for the State Reserve Bureau (SRB) of China in 2005.

W

WThe Sumitomo copper affair refers to a metal trading scandal in 1996 involving Yasuo Hamanaka, the chief copper trader of the Japanese trading house Sumitomo Corporation (Sumitomo). The scandal involves unauthorized trading over a 10-year period by Hamanaka, which led Sumitomo to announce $1.8 billion USD in related losses in 1996 when Hamanaka's trading was discovered, and more related losses subsequently. The scandal also involved Hamanaka's attempts to corner the entire world's copper market through LME Copper futures contracts on the London Metal Exchange (LME).

W

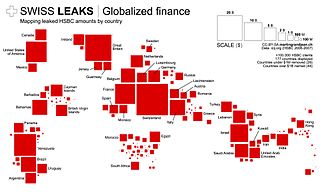

WSwiss Leaks is the name of a journalistic investigation, released in February 2015, of a giant tax evasion scheme allegedly operated with the knowledge and encouragement of the British multinational bank HSBC via its Swiss subsidiary, HSBC Private Bank (Suisse). Triggered by leaked information from French computer analyst Hervé Falciani on accounts held by over 100,000 clients and 20,000 offshore companies with HSBC in Geneva, the disclosed information has been called "the biggest leak in Swiss banking history".

W

WThe Swiss investment bank and financial services company, UBS Group AG, has been at the center of numerous tax evasion and avoidance investigations undertaken by U.S., French, German, Israeli, and Belgian tax authorities as a consequence of their strict banking secrecy practices.

W

WFerdinand De Wilton Ward, Jr. (1851–1925), known first as the "Young Napoleon of Finance," and subsequently as "the Best-Hated Man in the United States," was an American swindler. The collapse of his pyramid scheme caused the financial ruin of many people, including famous persons such as Thomas Nast and the former U.S. President Ulysses S. Grant, who had helped him start his banking business.

W

WThe Wells Fargo account fraud scandal is a controversy brought about by the creation of millions of fraudulent savings and checking accounts on behalf of Wells Fargo clients without their consent. News of the fraud became widely known in late 2016 after various regulatory bodies, including the Consumer Financial Protection Bureau (CFPB), fined the company a combined US$185 million as a result of the illegal activity. The company faces additional civil and criminal suits reaching an estimated $2.7 billion by the end of 2018. The creation of these fake accounts continues to have legal and financial ramifications for Wells Fargo and former bank executives as of early 2021.