W

WThe Banco del Giro, also Banco Giro or Bancogiro, sometimes referred to in English as the Bank of Venice, was a public bank created by the Republic of Venice in 1524 and extant until 1806. It was governed by a magistrate called the Depositario.

W

WBanco di Napoli S.p.A., among the oldest banks in the world, was an Italian banking subsidiary of Intesa Sanpaolo group, as one of the 6 retail brands other than "Intesa Sanpaolo". It was acquired by the Italian banking group Sanpaolo IMI in 2002 and ceased being an independent bank. In February 2018, Intesa Sanpaolo announced their new business plan, which would retire Banco di Napoli and other brands; the legal person of Banco di Napoli would be absorbed into Intesa Sanpaolo S.p.A.

W

WBank Melli Iran is the first national and commercial retail bank of Iran. It is considered as the largest Iranian company in terms of annual income with a revenue of 364 657 billion Rials in 2016. It is the largest bank in the Islamic world and in the Middle East. By the end of 2016, BMI had a net asset of $76.6 billion and a vast network of 3.328 banking branches; so it is known as the largest Iranian bank based on the amount of assets. The brand of BMI was recognized as one of the 100 top Iranian brands in 10th National Iranian Heroes Championship in 2013. The National Bank has 3328 active branches inside, 14 active branches and 4 sub-stations abroad and it has 180 booths. The first managing director of BMI was Kurt Lindenblatt from Germany. Also, the first foreign branch of BMI was opened in Hamburg, Germany in 1948.

W

WThe Bank of Amsterdam was an early bank, vouched for by the city of Amsterdam, and established in 1609. It was the first public bank to offer accounts not directly convertible to coin. As such, it can be described as the first true central bank. Unlike the Bank of England, established almost a century later, it neither managed the national currency nor acted as a lending institution ; it was intended to defend coinage standard. The role of the Wisselbank was to correctly estimate the value of coins and thus make debasement less profitable. It occupied a central position in the financial world of its day, providing an effective, efficient and trusted system for national and international payments, and introduced the first ever international reserve currency, the bank guilder. The model of the Wisselbank as a state bank was adapted throughout Europe, including the Bank of Sweden (1668) and the Bank of England (1694). David Hume praised the Bank of Amsterdam for its policy of 100 percent specie-backed deposit reserves.

W

WThe Bank of North America was the first chartered bank in the United States, and served as the country's first de facto central bank. Chartered by the Congress of the Confederation on May 26, 1781, and opened in Philadelphia on January 7, 1782, it was based upon a plan presented by US Superintendent of Finance Robert Morris on May 17, 1781, based on recommendations by Revolutionary era figure Alexander Hamilton. Although Hamilton later noted its "essential" contribution to the war effort, the Pennsylvania government objected to its privileges and reincorporated it under state law, making it unsuitable as a national bank under the federal Constitution. Instead Congress chartered a new bank, the First Bank of the United States, in 1791, while the Bank of North America continued as a private concern.

W

WThe Bank of Saint George was a financial institution of the Republic of Genoa. It was founded in 1407 to consolidate the public debt, which had been escalating due to the war with Venice for trading and financial dominance. The Bank's primary mission was to facilitate the management of the San Giorgio shares (luoghi). It was one of the oldest chartered banks in Europe and of the world. The Bank's headquarters were at the Palazzo San Giorgio, which was built in the 13th century by order of Guglielmo Boccanegra, uncle of Simone Boccanegra, the first Doge of Genoa.

W

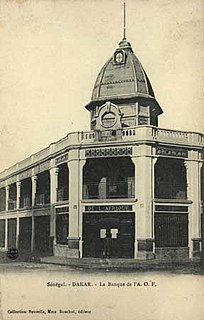

WBanque d'Afrique Occidentale : was a bank French colonial authorities established in 1901 in Dakar, Sénégal, as the central bank of the colonies of French West Africa.

W

WThe East African Currency Board (EACB) was established in 1919 to supply and oversee the currency of British colonies in British East Africa. It was established after Britain took control of mainland Tanzania from Germany at the end of World War I, and originally oversaw the territories of Uganda, Kenya, and Tanzania. Zanzibar joined the currency area in 1936. It operated out of premises at 4 Millbank, London SW1, one time the offices of the Crown Agents.

W

WThe President, Directors and Company of the Bank of the United States, commonly known as the First Bank of the United States, was a national bank, chartered for a term of twenty years, by the United States Congress on February 25, 1791. It followed the Bank of North America, the nation's first de facto national bank. However, neither served the functions of a modern central bank: They did not set monetary policy, regulate private banks, hold their excess reserves, or act as a lender of last resort. They were national insofar as they were allowed to have branches in multiple states and lend money to the US government. Other banks in the US were each chartered by, and only allowed to have branches in, a single state.

W

WThe Bank deutscher Länder (Bank of German States), abbreviation BdL, was the first central bank for the Deutsche Mark. It was founded on 1 March 1948 and was replaced in 1957 by the Deutsche Bundesbank.

W

WThe State Bank of the GDR was the central bank of East Germany. It was established on 1 January 1968 from the Deutsche Notenbank and took over the majority of the same tasks.

W

WGosbank was the central bank of the Soviet Union and the only bank in the entire country from the 1930s to 1987. Gosbank was one of the three Soviet economic authorities, the other two being "Gosplan" and "Gossnab". The Gosbank closely collaborated with the Soviet Ministry of Finance to prepare the national state budget.

W

WThe Hamburger Bank was a public credit institution founded in 1619 by the Free City of Hamburg. It operated independently until 31 December 1875, when it became part of the newly created Reichsbank.

W

WThe Imperial Bank of Persia was a British bank that operated as the state bank and bank of issue in Iran between 1889 and 1929. It was established in 1885 with a concession from the Persian government to Baron Julius De Reuter a German–Jewish banker and businessman who later became a Christian and a British subject.

W

WThe Bank of Joseon or Bank of Chosen was the central bank of Colonial Korea, and of South Korea. The bank issued the Korean yen from 1910 to 1945 and the won from 1945 to 1950.

W

WThe Central Bank of Manchou, was the central bank of the Japan-sponsored state of Manchukuo. The bank was established by the Bank of Manchukuo Act at Hsinking on 11 June 1932, as a joint stock company with a capital of 30,000,000 yuan, with the government holding at least 25% and at most 50% at any time. The bank officially opened its doors for business on July 1 as the amalgamation of the four note-issuing banks active in Manchuria prior to that time, namely: the Bank of the Three Eastern Provinces, the Bank of Kirin, the Bank of Heilungkiang and the Frontier Bank controlled by local warlord Chang Tso-lin. It was later revealed by audits that acquiring the four previous banks of Manchuria to be financially irresponsible as the Central Bank of Manchou held a deficit of 30,000,000 yuan in combined liabilities, but the action was deemed necessary as it was the only way to get rid of the overabundant currency issued by those banks in Manchuria in order to create a better foundation for the new Manchukuo yuan. When the Central Bank of Manchou was created it had a sufficient number of gold reserves for the new currency and paid out a dividend of 6% to investors, the stable value of the Manchukuo yuan was a major contributing factor for the development of the economy of Manchukuo.

W

WThe Mississippi Company was a corporation holding a business monopoly in French colonies in North America and the West Indies. In 1717, the Mississippi Company received a royal grant with exclusive trading rights for 25 years. The rise and fall of the company is connected with the activities of the Scottish financier and economist John Law who was then the Controller General of Finances of France. When the speculation in French financial circles, and the land development in the region became frenzied and detached from economic reality, the Mississippi bubble became one of the earliest examples of an economic bubble.

W

WOldenburgische Landesbank AG (OLB) is a private financial institution based in the northwest of Germany. Its headquarters are in Oldenburg.

W

WThe Ottoman Bank, formerly the Imperial Ottoman Bank, was a bank founded in 1856 at Bankalar Caddesi in the Galata business quarter of Constantinople, the capital of the Ottoman Empire, as a joint venture between British interests, the Banque de Paris et des Pays-Bas of France, and the Ottoman government.

W

WThe Reichsbank was the central bank of the German Reich from 1876 until 1945.

W

WThe Second Bank of the United States was the second federally authorized Hamiltonian national bank in the United States. Located in Philadelphia, Pennsylvania, it was chartered from February 1816 to January 1836. The bank's formal name, according to section 9 of its charter as passed by Congress, was "The President Directors and Company of the Bank of the United States". While other banks in the US were chartered by and only allowed to have branches in a single state, it was authorized to have branches in multiple states and lend money to the US government.

W

WThe Ta-Ching Government Bank, known as the Ta-Ching Bank of the Ministry of Revenue (大清戶部銀行) from 1905 to 1908, was the name of the Bank of China as a government agency of the Manchu Qing dynasty until the empire's dissolution in 1911. It was originally created to serve as the central bank of China in 1905, originally as a division of the Ministry of Revenue, and would serve as the country's de facto central bank until the establishment of the Central Bank of China in 1924.

W

WThe Taula de canvi, also Taula de cambi or simply Taula, was a type of municipal public bank that existed in the Crown of Aragon in the late Middle Ages and early modern period. The Taula de canvi of Barcelona, created in 1401 and still extant in diminished form in the 19th century, has been described as the first-ever central bank.