W

WFrom October 1 to October 17, 2013, the United States federal government entered a shutdown and curtailed most routine operations because neither legislation appropriating funds for fiscal year 2014 nor a continuing resolution for the interim authorization of appropriations for fiscal year 2014 was enacted in time. Regular government operations resumed October 17 after an interim appropriations bill was signed into law.

W

WThe American Taxpayer Relief Act of 2012 was enacted and was passed by the United States Congress on January 2, 2013, and was signed into law by US President Barack Obama the next day.

W

WIn the United States Congress, an appropriations bill is legislation to appropriate federal funds to specific federal government departments, agencies and programs. The money provides funding for operations, personnel, equipment and activities. Regular appropriations bills are passed annually, with the funding they provide covering one fiscal year. The fiscal year is the accounting period of the federal government, which runs from October 1 to September 30 of the following year. Appropriations bills are under the jurisdiction of the United States House Committee on Appropriations and the United States Senate Committee on Appropriations. Both Committees have twelve matching subcommittees, each tasked with working on one of the twelve annual regular appropriations bills.

W

WThe Bipartisan Budget Act of 2013 is a federal statute concerning spending and the budget in the United States, that was signed into law by President Barack Obama on December 26, 2013. On December 10, 2013, pursuant to the provisions of the Continuing Appropriations Act, 2014 calling for a joint budget conference to work on possible compromises, Representative Paul Ryan and Senator Patty Murray announced a compromise that they had agreed to after extended discussions between them. The law raises the sequestration caps for fiscal years 2014 and 2015, in return for extending the imposition of the caps into 2022 and 2023, and miscellaneous savings elsewhere in the budget. Overall, the bill is projected to lower the deficit by $23 billion over the long term.

W

WThe Bipartisan Budget Act of 2018 is a federal statute concerning spending and the budget in the United States, that was signed into law by President Donald Trump on February 9, 2018. Delays in the passage of the bill caused a nine-hour funding gap. The bill is the third in a series that increased spending caps originally imposed by the Budget Control Act of 2011; the first two were the Bipartisan Budget Act of 2013 and the Bipartisan Budget Act of 2015.

W

WThe Budget Control Act of 2011 is a federal statute enacted by the 112th United States Congress and signed into law by US President Barack Obama on August 2, 2011. The Act brought conclusion to the 2011 US debt-ceiling crisis.

W

WThe Bureau of the Public Debt was an agency within the Fiscal Service of the United States Department of the Treasury. United States Secretary of the Treasury Timothy Geithner directed the Bureau be combined with the Financial Management Service into the single Bureau of the Fiscal Service in 2012.

W

WA Comprehensive Annual Financial Report is a set of U.S. government financial statements comprising the financial report of a state, municipal or other governmental entity that complies with the accounting requirements promulgated by the Governmental Accounting Standards Board (GASB). GASB provides standards for the content of a Comprehensive Annual Financial Report in its annually updated publication Codification of Governmental Accounting and Financial Reporting Standards. The U.S. Federal Government adheres to standards determined by the Federal Accounting Standards Advisory Board (FASAB).

W

WThe history of the United States debt ceiling deals with movements in the United States debt ceiling since it was created in 1917. Management of the United States public debt is an important part of the macroeconomics of the United States economy and finance system, and the debt ceiling is a limitation on the federal government's ability to manage the economy and finance system. The debt ceiling is also a limitation on the federal government's ability to finance government operations, and the failure of Congress to authorise an increase in the debt ceiling has resulted in crises, especially in recent years.

W

WPublic Law 113-2, containing Division A: Disaster Relief Appropriations Act, 2013 and Division B: Sandy Recovery Improvement Act of 2013 is a U.S. appropriations bill authorizing $60 billion for disaster relief agencies. The Budget Control Act of 2011 (BCA), had authorized only disaster spending and emergency spending to exceed established spending caps. While emergency spending is not subject to the caps in the BCA, spending for disaster relief is calculated by taking the average of the previous ten years disaster relief spending, excluding the highest and lowest spending years.

W

WThe financial position of the United States includes assets of at least $269.6 trillion and debts of $145.8 trillion to produce a net worth of at least $123.8 trillion as of Q1 2014.

W

WThe Government Finance Officers Association is a professional association of approximately 19,000 state, provincial, and local government finance officers in the United States and Canada. GFOA is headquartered in downtown Chicago.

W

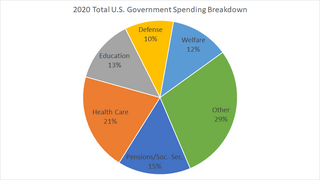

WGovernment spending in the United States is the spending of the federal government of the United States, and the spending of its state and local governments.

W

WThe Gramm–Rudman–Hollings Balanced Budget and Emergency Deficit Control Act of 1985 and the Balanced Budget and Emergency Deficit Control Reaffirmation Act of 1987 were the first binding spending constraints on the federal budget.

W

WThe history of the United States public debt started with federal government debt incurred during the American Revolutionary War by the first U.S treasurer, Michael Hillegas, after its formation in 1789. The United States has continuously had a fluctuating public debt since then, except for about a year during 1835–1836. To allow comparisons over the years, public debt is often expressed as a ratio to gross domestic product (GDP). Historically, the United States public debt as a share of GDP has increased during wars and recessions, and subsequently declined.

W

WMonetary policy concerns the actions of a central bank or other regulatory authorities that determine the size and rate of growth of the money supply. For example, in the United States, the Federal Reserve is in charge of monetary policy, and implements it primarily by performing operations that influence short-term interest rates.

W

WThe National Debt Clock is a billboard-sized running total display that shows the United States gross national debt and each American family's share of the debt. It is currently installed on the western side of One Bryant Park, west of Sixth Avenue between 42nd and 43rd Streets in Manhattan, New York City. It was the first debt clock installed anywhere.

W

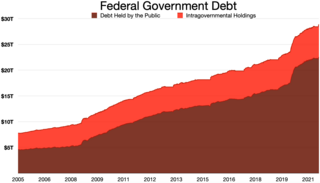

WThe national debt of the United States is the total national debt owed by the federal government of the United States to Treasury security holders. The national debt at any point in time is the face value of the then outstanding Treasury securities that have been issued by the Treasury and other federal government agencies. The terms "national deficit" and "national surplus" usually refer to the federal government budget balance from year to year, not the cumulative amount of debt. In a deficit year the national debt increases as the government needs to borrow funds to finance the deficit, while in a surplus year the debt decreases as more money is received than spent, enabling the government to reduce the debt by buying back some Treasury securities. In general, government debt increases as a result of government spending and decreases from tax or other receipts, both of which fluctuate during the course of a fiscal year. There are two components of gross national debt:"Debt held by the public" – such as Treasury securities held by investors outside the federal government, including those held by individuals, corporations, the Federal Reserve, and foreign, state and local governments. "Debt held by government accounts" or "intragovernmental debt" – is non-marketable Treasury securities held in accounts of programs administered by the federal government, such as the Social Security Trust Fund. Debt held by government accounts represents the cumulative surpluses, including interest earnings, of various government programs that have been invested in Treasury securities.

W

W"Starving the beast" is a political strategy employed by American conservatives to limit government spending by cutting taxes, in order to deprive the federal government of revenue in a deliberate effort to force it to reduce spending. The term "the beast", in this context, refers to the United States Federal Government and the programs it funds, using mainly American taxpayer dollars, particularly social programs such as education, welfare, Social Security, Medicare, and Medicaid.

W

WUnited States Treasury securities are government debt instruments issued by the United States Department of the Treasury to finance government spending as an alternative to taxation. Treasury securities are often referred to simply as Treasurys. Since 2012, U.S. government debt has been managed by the Bureau of the Fiscal Service, succeeding the Bureau of the Public Debt.

W

WWar savings stamps were issued by the United States Treasury Department to help fund participation in World War I and World War II. Although these stamps were distinct from the postal savings stamps issued by the United States Post Office Department, the Post Office nevertheless played a major role in promoting and distributing war savings stamps. In contrast to Liberty Bonds, which were purchased primarily by financial institutions, war savings stamps were principally aimed at common citizens. During World War I, 25-cent Thrift stamps were offered to allow individuals to accumulate enough over time to purchase the standard 5-dollar War Savings Certificate stamp. When the Treasury began issuing war savings stamps during World War II, the lowest denomination was a 10-cent stamp, enabling ordinary citizens to purchase them. In many cases, collections of war savings stamps could be redeemed for Treasury Certificates or War Bonds.